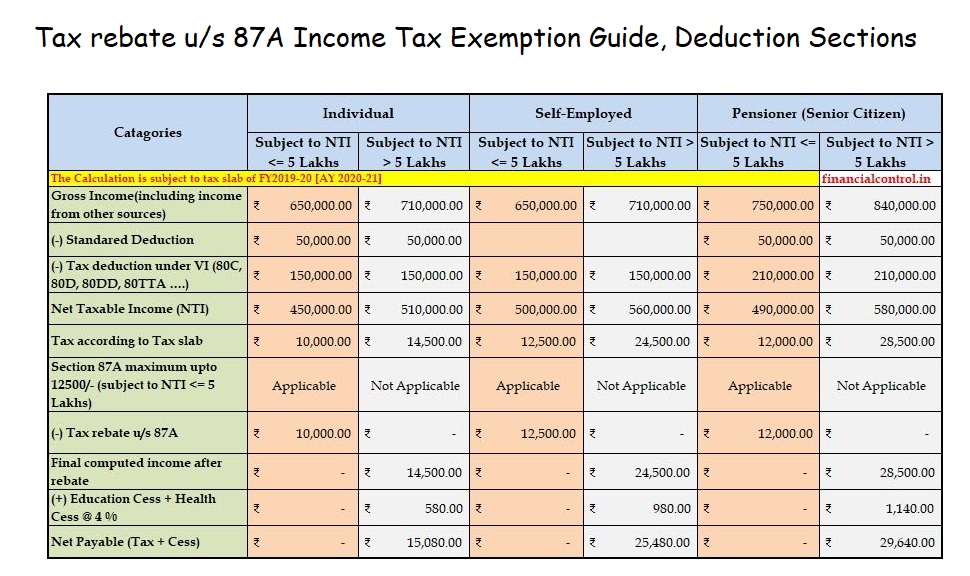

Tax rebate u/s 87A Income Tax Exemption Guide, Deduction Sections

Income Tax Deduction Sections of Assessment for the financial year 2022-2023

Rebate u/s 87A for FY 2022-23 (AY 2023-24)

Steps to claim a tax rebate under section 87A

- Calculate your gross total income for the financial year

- Reduce your tax deductions for tax savings, investments, etc.

- Arrive at your total income after reducing the tax deductions.

- Declare your gross income and tax deductions in ITR.

- Claim a tax rebate under section 87A if your total income does not exceed Rs 5 lakh.

- The maximum rebate under section 87A for the AY 2022-23 is Rs 12,500.

Important sections of the Income Tax – Tax rebates under section 87A Illustrations.

Important sections of the Income Tax Act you should know about.

Section 80C – Investments

If you have invested in avenues such as ELSS Mutual Funds, National Savings Certificates, Life Insurance Premiums, MF-Pension Plans, National Pension System, you can claim tax deductions under Section 80C. The maximum tax exemption under Section 80C is Rs. 1,50,000 for FY 2022-2023.

Income Tax Excel Softwares 2023

|

S.NO. |

INCOME TAX SOFTWARE |

DOWNLOAD |

|

1 |

IT Software 2022-23 for AP & Telangana for AY 2023-24 |

|

|

2 |

KSS Prasad Income Tax Software FY 2022-23 |

|

|

3 |

Putta Srinivas Reddy Income Tax Software FY 2022-23 |

|

|

4 |

Kota Vijay Kumar medakbadi Income Tax Software FY 2022-23 |

|

|

5 |

Zaheeruddin STO, Kakinada IT Software FY 2022-23 |

|

|

6 |

C.Ramanjaneyulu Income Tax Software FY 2022-23 |

|

|

7 |

B.Srinivasa Chary Income Tax Software FY 2022-23 |

|

|

8 |

Seshadri Income Tax Software FY 2022-23 |

|

|

9 |

Ramzan Ali Income Tax Software FY 2022-23 |

|

|

10 |

Mobile Version Income Tax Software FY 2022-23 |

|

|

11 |

Model School Teachers (APMS IT) Software FY 2022-23 |

|

|

12 |

DSC Wise Teachers IT Calculation Tables 2022-23 for AP, TS |

|

|

13 |

IT Softwares 2022-23 AP TS Teachers, Employees with PRC Arrears |

|

|

14 |

AP Employee Online Salary Details, Online Employee Pay Details |

|

|

15 |

TS Employees, Teachers Pay details, Month wise Salary Statement |

|

|

16 |

Telangana Employees Salary certificate |

|

|

17 |

How to Download SBI Home Loan Statement Interest and Principal |

|

|

18 |

How to Get LIC Premium Statements for Income Tax Purpose |

|

|

19 |

How to Pay PLI ( Postal Life Insurance ) Premium Online |

|

|

20 |

Tax Rebate u/s 87A Income Tax Exemption Guide |

|

|

21 |

Income Tax Slab Rates and Deductions Analysis for FY 2022-23 |

|

|

22 |

How to do Income Tax E-Filing Online Step by Step Process |

|

|

23 |

Income Tax e-Filing Processed (Confirmed) OR Not? Check Here |

Section 80CCD – Government Pension Schemes

This applies to anyone who has contributed to any pension scheme operated by the Government of India (like the National Pension System). You can claim tax benefits equal to the contributed amount (not more than 10% of your salary) and an additional Rs. 50,000 under Section 80CCD.

Section 80CCG – Equity Investments

The Section 80CCG or Rajiv Gandhi Equity Savings Scheme deduction was introduced to encourage investments in equity shares. Under this section, you can get tax deductions up to 50% of the amount you have invested in equity shares or Rs. 25,000, whichever is lower.

Softwares:IT Software Programs, Tax Rates, Rebates for 2023

Section 80D – Health Insurance

Have you invested in Health Insurance for yourself and your family (this includes your spouse, parents and dependent children)? If you answered yes to that question, then you can get a tax deduction of Rs. 25,000 on your Health Insurance premium under Section 80D. If the insured is a senior citizen (above 60 years of age), he or she will be entitled to a tax exemption of Rs. 30,000.

Furthermore, you can claim medical reimbursements up to Rs. 15,000 (under Section 17(2) of the IT Act) from your employer, by submitting the medical bills. This amount is not taxable.

Section 80DDB – Critical Illness

Under this section, a tax deduction of Rs. 40,000 (for individuals below 60 years of age) can be claimed on the grounds of medical treatment for specified ailments such as cancer, AIDS, chronic renal failure, thalassaemia, etc. You can claim this deduction for yourself or on behalf of your dependents. However, you have to submit a prescription from a specialist doctor to claim it.

Section 80TTA – Savings Account

The interest you earn on your savings accounts in a bank, post office or a co-operative society is exempt from tax for up to Rs. 10,000. This tax exemption is not applicable on interest earned via Fixed Deposits.

Section 56(2) – Gift Tax

This section applies to taxes on gifts. If you receive gifts (in the form of cash, cheque, etc.) with a value of Rs. 50, 000 (or less) from anyone other than your blood relations, then you don’t have to pay tax for the same. If the value of the gift is more than Rs. 50,000, then the full amount is taxable. Gifts from blood relations are 100% tax-free.

Section 10(14) – Transport Allowance and Children Education Allowance (CEA)

Under Section 10(14), the Budget FY 2016-17 lets you claim Rs. 19,200 tax exemption as transport allowance and Rs. 2,400 tax exemption as Children Education Allowance (CEA) in a financial year.

Section 80GG – House Rent Allowance

For salaried individuals living in rented houses, the House Rent Allowance (HRA) is a great tax saving option. The tax benefits that you get depend on your basic salary, HRA provided by your employer, your place of residence and the rent you pay/declare.

Section 24(b) – Home Loan

If you have taken a Home Loan, then you can claim a tax deduction on the interest component of the loan under Section 24(b). For self-occupied properties, you can benefit from deductions of up to Rs. 2,00,000.

Section 80G – Charity and Relief Funds

Have you made contributions to charitable organizations and relief funds? You can claim tax exemptions up to 50% of the amount, if you have paid via cheque, draft or cash (not exceeding Rs. 10,000). Contributions made to a few select organizations can get you 100% tax exemption.

Section 80GGB – Political Party Contributions

A tax exemption option for Indian companies, Section 80GGB provides 100% exemption on any amount contributed by a company to political parties or an electoral trust.

Section 80EE – First-time Home Buyers

Newly incorporated within the Income Tax Act, Section 80EE comes as a great option for first-time home buyers. If you’re buying a house for the first time and have taken a Home Loan to pay for it, then you can claim an additional Rs. 50,000 tax deduction on your Home Loan interest. You’re eligible for this tax deduction claim if:

1. Your home loan was sanctioned in the financial year 2016-17.

2. The loan amount does not exceed Rs. 35 lakh.

3. The value of your house is within Rs. 50 lakh.

4. You should not have any other residential property in your name.

Section 80E – Education Loan

If you have taken a loan for higher education after the completion of your Senior Secondary Exam, then you can claim a tax deduction under Section 80E on the interest paid towards the loan. The loan should have been taken for higher education for yourself, your spouse, your children or any student for whom you are the local guardian. This deduction can be claimed for up to 8 years or till the interest is paid, whichever is earlier. There is no limit on the amount of interest you can claim for tax exemption.

1. Life Insurance Premium

2. Premium / Subscription for deferred annuity For individual, on life of self, spouse or any child .

3. Sum deducted from salary payable to Govt. Servant for securing deferred annuity for self-spouse or child Payment limited to 20% of salary.

4. Contribution made under Employee’s Provident Fund Scheme.

5. Contribution to PPF For individual, can be in the name of self/spouse, any child & for HUF, it can 6. be in the name of any member of the family.

7. Contribution by employee to a Recognised Provident Fund.

8. Sum deposited in 10 year/15 year account of Post Office Saving Bank

9. Subscription to any notified securities/notified deposits scheme. e.g. NSS

10. Subscription to any notified savings certificate, Unit Linked Savings certificates. e.g. NSC VIII issue.

11. Contribution to Unit Linked Insurance Plan of a Mutual Fund

12. Contribution to fund set up by the National Housing Scheme.

13. Housing Loan Principal amount paid

14. Tuition fees paid at the time of admission or otherwise to any school, college, university or other educational institution situated within India for the purpose of full time education of any two children. Available in respect of any two children.

Section 80CCG:

As per the Budget 2012 announcements, a new scheme Rajiv Gandhi Equity Saving Scheme (RGESS) will be launched. Those investors whose annual income is less than Rs. 10 lakh (proposed Rs. 12 lakh from A.Y. 2015-16) can invest in this scheme up to Rs. 50,000 and get a deduction of 50% of the investment. So if you invest Rs. 50,000 (maximum amount eligible for income tax rebate is Rs. 50,000), you can claim a tax deduction of Rs. 25,000 (50% of Rs. 50,000).

Section 80E:

Deduction in respect of Various Donations 100% or 50% without Restrictions.

Deduction in respect of contributions given by any person to political parties

Income Tax Caliculations

#Updated Income Tax Software 2023 for AP &TS

Related Posts

Putta IT IncomeTax Software 2024 (FY 2023-24) for AP, TS Teachers, Employees Prepared by Sri. Putta Srinivas Reddy Updated Latest Final Version Download

AP Schools Summer MDM implementation guidelines in drought affected Mandals 2016